To effectively manage your money in today’s global economy, understanding international financial trends is vital. This applies whether you are considering a term deposit or exploring other investment avenues.

The inflation rate Australia currently faces is not just a local issue; global forces significantly influence it. Similarly, the wider landscape of international monetary policy sets benchmarks for and often impacts domestic term deposit rates. Simply looking at the headline rate for a term deposit, without considering the inflation rate Australia, can be misleading.

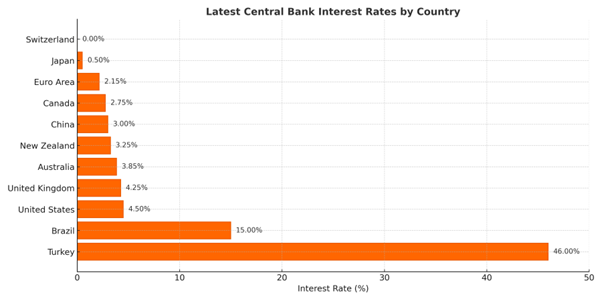

Let’s begin by looking at global central bank policy rates. Recent data from reputable sources like global-rates.com (as of July 2025) shows a striking variety in how different countries manage their monetary policy. A selected comparison effectively highlights this diversity.

For instance, data from global-rates.com reveals some interesting points. Nations like Turkey (e.g., 46.00%) and Brazil (e.g., 15.00%) show exceptionally high benchmark rates. These high rates often reflect strong actions to fight high inflation in those countries.

In contrast, other economies such as Switzerland (e.g., 0.00%) and Japan (e.g., 0.50%) operate with very low, or even zero, policy rates. This shows a very different approach to their economies. Major economies like the United States (e.g., 4.50%) and the United Kingdom (e.g., 4.25%) sit in a more moderate range. Australia, with its central bank rate listed (e.g., at 3.85%), also holds a moderate position when compared to these diverse global examples.

Comparative Central Bank Policy Rates for Selected Global Economies. Source: global-rates.com

This global variation clearly shows that the term deposit rates offered in Australia are shaped by our domestic conditions. However, we must also consider them within a broader context of global yields and risks. The inflation rate Australia currently faces will always influence how attractive any given term deposit appears. our domestic conditions shape the term deposit rates offered in Australia.

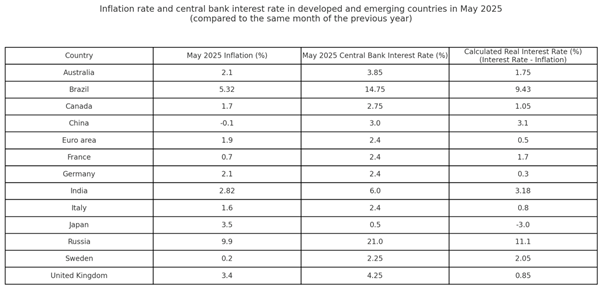

However, the interest rate you see doesn’t tell the whole story. What truly matters is the real rate of return – that’s the interest rate after you subtract inflation. To gain a better understanding, let’s examine a focused comparison of forecasted inflation and central bank rates for select key countries in May 2025, based on the provided data. This comparison shows if a term deposit is likely to grow your wealth when you consider the inflation rate in Australia.

A chart like this would clearly show these key insights from the May 2025 data. This directly impacts the outlook for term deposit rates versus the inflation rate Australia:

- Australia: The data shows an inflation rate Australia of 2.1% and a central bank interest rate of 3.85%. This means a positive real interest rate of about 1.75%. This is a critical point. It helps when judging if current term deposit rates for a new term deposit are likely to keep your money’s purchasing power.

- Strong Positive Real Rates: Countries like Russia (11.1%) and Brazil (9.43%) show much larger positive bars. This indicates their central bank rates are well above their high inflation. Their version of a term deposit might offer high nominal returns but would come with different risks compared to an Australian term deposit.

- Significant Negative Real Rates: Japan stands out with a real interest rate of about -3.0%. In this case, the interest rate is much lower than inflation. Money held in savings, or a term deposit loses purchasing power.

This comparison of real interest rates is very important. It highlights a key point: even if the inflation rate Australia goes down, you must still check the actual return offered by a term deposit against that inflation. If the term deposit rates you get don’t beat the inflation rate Australia, the real value of your savings in a term deposit will fall over time. This isn’t just an issue for Australia; it varies a lot between countries.

Navigating Low Real Returns and Exploring Alternatives

So, what can you do when the real returns from common options like a term deposit are low or even negative? This often happens if term deposit rates don’t keep up with a persistent inflation rate Australia.

In such times, savvy individuals and businesses often look for other investment strategies. These alternatives may carry different risks, but they aim to offer returns that can better fight the inflation rate Australiaand help money grow.

For those exploring such options, some funds have specific features to meet these needs. For instance, Trivesta Protected Yield Fund (TPYF) details its offering as follows:

- 10% p.a. Target Return (Net of Fees): The fund aims for a 10% annual return, paid via a fixed distribution schedule.

- Monthly and Semi-Annual Payouts: Investors receive a fixed 0.5% monthly distribution (plus bonus distributions of 2% in the 6th and 12th months). Trivesta Protected Yield Fund (TPYF) delivers a consistent, fixed monthly income, rare among typical bond or cash funds.

- Fully Redeemable & Flexible: Trivesta Protected Yield Fund (TPYF) offers monthly full redemption with no penalty, giving investors liquidity on demand. Unlike locked-in term deposits, you can cash out according to a simple notice period.

(This information is provided for general informational purposes only and does not constitute financial product advice or an offer to invest. Past performance is not a reliable indicator of future performance.)

Professional Financial Management and Future Planning

Ultimately, a professional approach to financial management means understanding a few key things. You need to know where Australian term deposit rates and the inflation rate Australia stand, not just locally, but within the wider global context.

Analysing real interest rates, as shown with the comparative data, gives a much clearer picture of potential outcomes from a term deposit. This analysis underscores the critical importance of considering a diverse range of strategies to achieve your financial goals, especially when the inflation rate Australia and available term deposit rates are changing.

Here are key aspects of professional financial management and future planning:

- Stay Informed on Trends: Keep abreast of economic trends impacting investments. Rising inflation ratescan diminish savings’ purchasing power, making it crucial to find opportunities that outpace inflation. This highlights the vital link between term deposit ratesand inflation for your financial health.

- Diversify Your Portfolio: Diversifying your investment portfolio mitigates risks. Instead of solely relying on a term deposit, spread investments across asset classes like stocks, bonds, and real estate. This protects capital and increases potential returns, a cornerstone of robust financial planning.

- Regularly Review Strategy: Regularly reviewing your financial strategy is paramount. As market conditions evolve, so should your investment approach. Assess goals, risk tolerance, and current investment performance to adapt and seize opportunities, ensuring financial plans remain aligned.

- Seek Professional Advice: Never hesitate to seek professional advice. Financial advisors provide personalised insights tailored to your unique situation. They navigate the complexities, providing expert guidance on term deposit rates, the inflation rate Australia, and alternative investments. This ensures informed decisions for robust financial growth and security.

FQAs

How can Aussies navigate inflation with smart investments?

In today’s high cost of living, where the inflation rate in Australia continues to strain budgets, smart investing is essential. With CPI rising and wages lagging, traditional savings often fail to protect real value. To keep ahead, Aussies can explore alternative investments that offer steady income and inflation protection. Options like fixed-income funds with monthly payouts provide stability and flexibility, which are key when essentials like rent continue to rise. Staying informed and making data-driven choices can help preserve wealth and support long-term financial well-being.

How else can Australians grow their wealth?

Beyond high-interest savings, Australians can grow their wealth through smarter financial planning—understanding income, assets, and long-term goals like retirement or estate needs.

Exploring alternative Investments such as private credit, property, or income-focused funds like the Trivesta Protected Yield Fund can boost returns, offer diversification, and help hedge against inflation. Though not without risk, these options can outperform traditional savings in today’s shifting economy.

After RBA rate cuts, can fixed income still generate growth?

Yes—despite lower returns from traditional term deposits, alternative fixed-income investments can still offer strong income potential. With the RBA cutting the cash rate to 3.85%, many investors are turning to income-focused strategies that provide fixed monthly returns and flexible access to capital. These alternatives are less affected by rate cuts, delivering reliable income, capital protection, and liquidity, making them a smart choice in a low-rate environment.