The current economic environment in Australia presents a complex and often challenging picture for many households. Understanding key indicators, such as the inflation rate in Australia and its relationship with the average wage in Australia, is no longer just academic; it’s crucial for informed financial decision-making. As the cost of living continues to be a primary concern, individuals are increasingly looking for ways to preserve and grow their wealth.

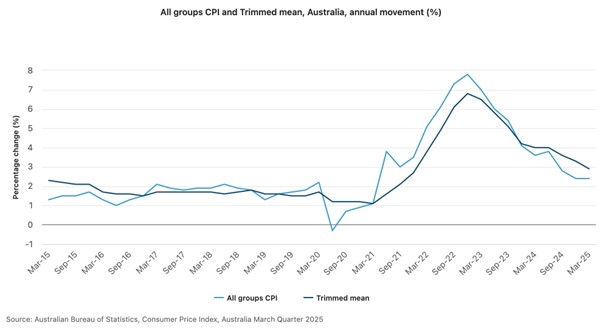

One of the most significant figures shaping our financial landscape is the inflation rate in Australia, officially measured by the Australian CPI (Consumer Price Index). This CPI Australia figure directly reflects the rate at which the general level of prices for a basket of goods and services is rising, thereby eroding purchasing power. The recent trajectory of this inflation rate in Australia is clearly detailed by the Australian Bureau of Statistics, showing the quarterly and annual movements in the Australian CPI:

Recent movements in the All-groups CPI, Australia, illustrating quarterly and annual changes. The dark blue line represents the annual change in the Australian CPI, while the light blue bars show the change from the previous quarter. Source: Australian Bureau of Statistics.

This visual data vividly portrays the recent surge in the inflation rate in Australia. The dark blue line, representing the annual change in the Australian CPI, shows a steep climb, peaking at a significant 7.3% in the September 2022 quarter. These peak underscores a period of intense pressure on the cost of living. While the line indicates some subsequent moderation in the annual CPI Australia, it remains at levels that continue to impact the average wage in Australia. The light blue bars, showing quarterly changes, also highlight the persistence of these inflationary pressures, contributing to an elevated cost of living. When this inflation rate Australia is high, the real value of the average wage in Australia is diminished.

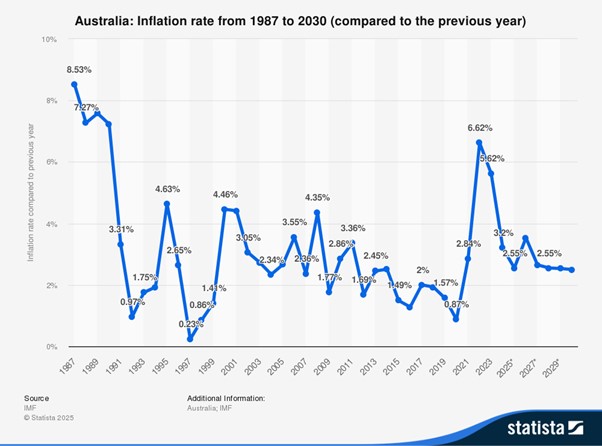

To place these recent movements in the inflation rate in Australia into a broader historical context, a long-term view from Statista reveals the trends in the CPI Australia over several decades:

Historical and projected inflation rate in Australia from 1987 to 2030 (annual % change, reflecting CPI Australia). Source: Statista.

This longer-term perspective allows us to compare the recent spike in the inflation rate in Australia (e.g., the 6.62% data point for 2023 shown here) with past economic cycles. It’s clear that while the recent increase in the CPI in Australia is substantial, Australia has faced periods of even higher inflation. However, this chart also emphasises that the recent surge in the inflation rate in Australia followed a relatively extended period of lower, more stable price growth, making the current high cost of living feel particularly acute for many. The challenge for the average wage earner in Australia to keep pace with such shifts in the inflation rate is evident from these historical patterns.

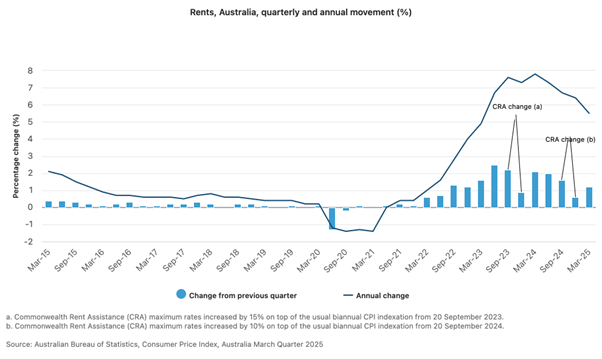

This inflationary pressure is felt acutely in everyday expenses, particularly when it comes to essentials like rent. The cost of housing is a major component of the cost of living for most Australians, and rising rent significantly impacts household budgets. The ABS specifically details the recent movements in rent prices, illustrating a clear trend:

Quarterly and annual percentage changes in rent across Australia. The dark blue line indicates the annual percentage change. Source: Australian Bureau of Statistics.

The data on rental movements paints a clear picture of accelerating rent inflation across Australia. The dark blue line in the graph above, tracking the annual percentage change, shows a dramatic upward trajectory, especially from 2022 onwards. This surge in rent directly contributes to the increasing cost of living. When combined with the broader inflation rate in Australia (as measured by CPI Australia), this sustained increase in rent means that the average wage in Australia is stretched thinner, impacting the financial well-being of many who are trying to manage their cost of living.

The cumulative effect of these trends, visualised in the provided data, is that many Australians are seeing their household budgets tighten. The challenge is clear: how can one manage their finances effectively when the cost of living is demonstrably high, and the purchasing power of the average wage in Australia is under pressure from the climbing Australian CPI? It’s a question on many minds, especially as data on the inflation rate in Australia and its impact on essentials like rent dominate financial news.

In this environment, exploring different financial strategies becomes paramount. While traditional savings accounts may struggle to offer returns that outpace a high inflation rate in Australia, some investors look towards avenues that aim for higher returns, though these inherently come with different risk profiles. As an example of features that certain alternative investment products might offer, consider the following:

- 10% p.a. Target Return (Net of Fees): The fund aims for a 10% annual return, paid via a fixed distribution schedule.

- Monthly and Semi-Annual Payouts: Investors receive a fixed 0.5% monthly distribution (plus bonus distributions of 2% in the 6th and 12th months). Trivesta Protected Yield Fund delivers a consistent, fixed monthly income, which is rare among typical bond or cash funds.

- Fully Redeemable & Flexible: Trivesta Protected Yield Fund offers monthly full redemption with no penalty, giving investors liquidity on demand. Unlike locked-in term deposits, you can cash out according to a simple notice period.

This information is provided for general informational purposes only and does not constitute financial product advice or an offer to invest. Past performance is not a reliable indicator of future performance.

While the average wage in Australia is a critical economic indicator, and the Australian CPI helps us understand the cost of living, exploring diverse financial instruments might be part of a broader strategy to navigate these challenging times. The aim is to achieve a return that potentially outpaces the inflation rate. Australia is a significant draw for many.

Ultimately, staying informed about the inflation rate in Australia, understanding the movements in the Australian CPI as illustrated by official data, and recognising how these affect the cost of living and essentials like rent relative to the average wage in Australia is the first step towards sound financial management and making more professional, data-driven decisions.

FQAs

“How to Avoid Costly Mistakes with Australia’s 2025 Land Tax Rules”

Why Australian Property May No Longer Be a Smart Investment in 2025

How Much Super Do You Need to Retire?

“This communication is intended only for Wholesale Clients as defined under the Corporations Act 2001 (Cth). It is not intended for distribution to, or reliance by, retail investors.